-

Negotiate Your Position The seller wants the most for their home and the buyer wants to pay the least possible. From the very beginning of the homebuying process, there are adversarial positions between the principals. If you happen to be in a multi-offer situation, it just complicates things further. Then, there are the emotions that tend to cloud the decision making on both sides of the transaction. Sellers have lived in the home for years, possibly, with cherished family experiences and maybe, having put considerable effort and money into capital improvements. On the buyer side, they may have lost out on several homes due to competing offers and now, this year, interest rates have doubled, and the discretionary funds required to pay for a home could be causing cuts in their budget in other areas. A year ago, buyers were waiving contingencies for financing, appraisals, inspections, and other things just to be competitive. Today, to make the home more affordable with the higher mortgage rates, buyers need the seller to make financial concessions but who is going to make their case to the seller for them? The role of a third-party negotiator played by the real estate professionals has always been valuable to the success of the transaction but now, it may even be essential. Sellers enjoyed an extraordinary market in their favor for the past two years with incredible appreciation and so many buyers chasing so few homes, the sellers were able to write their own ticket. Inflation and mortgage rates have put the brakes on the market, eliminating over 15 million mortgage-ready buyers. The buyers who are still in the market need to be cautious, so they don't overextend themselves and overpay for a home. The agents can assist both the buyers and sellers in seeing things in an objective way that reflects the current market and not the way it was a year ago. All parties must be reasonable and not expect too much. They need to consider facts and not feelings. Negotiating the sale or purchase of a home is a competition; for one person to get something, someone must give something up. If a person doesn't feel comfortable with this, it is important to work with an agent who can bring their skills to the table on your behalf. As your advocate, they can champion your position and put transactions together that would not have been possible if it were left to the principals alone. Negotiation skills are acquired through training and experience. When interviewing an agent, ask them what role negotiation plays in their marketing plan if you're a seller and purchase plan, if you are a buyer. An agent who cannot defend their position in the transaction may not be the right person to defend yours. The Sam Team at Houston Top Realty has over 47 years successfully negotiating our clients' position and we'd like to negotiatet for YOU! Call 832-200-5656 to get started.

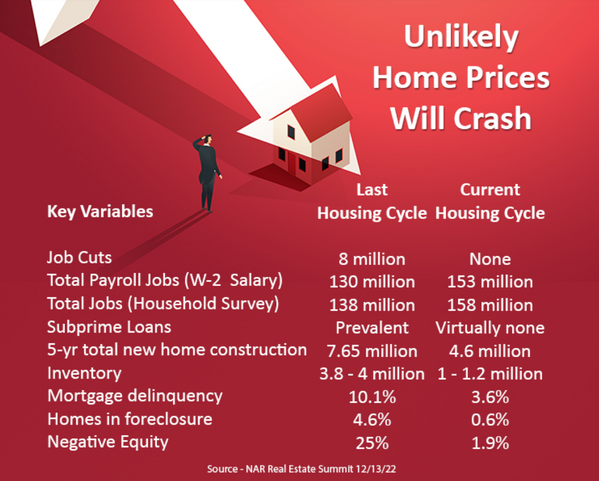

Read More GOOD NEWS! Home Prices NOT Expected to Crash

GOOD NEWS! Home Prices NOT Expected to Crash Good News from the recent Real Estate Summit held by the National Association of REALTORS® in December 2022. A comparison of the current Housing Cycle against the last such cycle shows a lot of distinct variables that should help to stabilize housing prices. Now we have to be creative in the financing to continue to support the American Dream of Homeownership -- the greatest hedge against inflation. So, if you're ready to start your pursuit of the market, call us to get started. You can reach a top associate of #TheSamTeam at #HoustonTopRealty at 832-200-5656. Experience the difference a Top Agent can do for you!

Read MoreBuilding Your Home Buying Team

Building Your Home Buying Team There are a lot of professionals involved in the homebuying process. And when these people can function as a team, the buyer is much more likely to end up where they want to be...in their new home. The lender is an integral part of the team unless you are going to be paying cash. Trust is very important when selecting this person because they are going to qualify you for the mortgage you need. The interest rate and fees should be fair based on your credit, income, and the market. You'll want someone who can close at the rate and terms that were quoted. In a rising market, you may want to consider locking in the rate so that it doesn't go up before you close. The appraiser is hired indirectly by the lender to determine the value of the home as part of the loan approval process. During the financial crisis of 2008, a process was created by the Dodd-Frank Wall Street Reform and the Consumer Protection Act to limit direct contact between borrowers, lenders, and appraisers. This requirement protects appraisers from being influenced by a lender. Sometimes, an Appraisal Management Companies, AMC, may assign an appraiser who may not be familiar with a particular area or type of property. The real estate agent can act as a liaison to provide additional information about the property and area that the appraiser would not necessarily know about initially. Once a contract has been fully agreed upon, one of the first steps is for the buyer to have a home inspection made by a professional. While most states require these professionals to be licensed, 14 states do not require one to perform inspections. In addition to being licensed, some inspectors belong to professional organizations that provide specialized education and suggest levels of performance. Recommendations from friends who have recently purchased a home would be helpful. Your agent may give you several names of inspectors and you can ask for the buyer's contact information who used them recently to verify their results. Pest control is not usually included in the normal home inspection. These are also licensed specialists who are concerned about termites, other insects, and vermin. If you do not have experience with a pest control company, recommendations from friends and your agent can give you a place to start. Property casualty insurance is required by the mortgage holder but even if you were paying cash for a home, it would be prudent to have insurance. A homeowners' policy provides the broadest coverage with fire and other named perils including burglary for both the dwelling and the contents. Liability is packaged with the other coverage to protect you if someone is hurt while on your property. Deciding based on policy price may not present a complete comparison. Another consideration is how the company handles claims in both time and settlement. The title insurance provider is usually named in the sales contract. There are two different policies that are usually offered simultaneously but paid for separately. The owner's title policy guarantees the buyer they are getting a clear and marketable title while the mortgagee's title policy guarantees the lender that they have an enforceable lien. The Real Estate Settlement Procedures Act gives the buyer the right to determine the provider. Surveys are commonly required when new mortgages are established to make sure there are not encroachments on the property lines. Even in a cash purchase, a buyer may want to get a survey for the same reason. In some cases, lenders might accept a seller's previously obtained survey. The title company usually order's the survey based on instructions from the contract or lender. A real estate attorney is required in some states to be involved in all transactions. In other situations, a real estate attorney may be involved to draw the legal documents but in no way is representing the interests of a specific person. A buyer or seller can consult an attorney and have them represent their interests in the transaction. Once a buyer understands if an attorney is not required in a real estate transaction, they are free to decide if they want legal representation. The listing agent is hired by the seller when they place their home on the market for sale. In many cases, the listing agent has a fiduciary duty to put the seller's interest above their own. These duties include loyalty, confidentiality, disclosure, obedience, reasonable care and diligence and accounting. The buyer's agent will interface with the listing agent in the various negotiations that will take place beginning with showing the property, offer, acceptance, and all the other steps that will lead to the settlement of the sale. Agency describes a legal relationship and can apply to seller's and buyer's agents and is created once an agreement is signed; a few states have provisions for oral agreements. Members of the National Association of REALTORS� subscribe to a code of ethics that describes their practice and behavior to clients and the public. There are many professionals involved in the purchase of a home. From a buyers' standpoint, it is helpful to have one person who is familiar with the process to be coordinating the efforts of the different parties to finish with a settlement and possession. There are a lot of steps and even if a buyer has been through the process before, they may not have the experience to anticipate difficulties and solve issues that could derail the transaction. The role of a third-party negotiator is a valuable role that the buyer's agent plays. While the buyer is in control, the buyer's agent can provide information and background necessary for sound decisions. The purchase of a home is the largest investment most people make. Like it takes a village to raise a child, it helps to have a team to buy a home. Finding an agent to keep your best interests at heart is the first team member you need to select. From there, your agent can help you find the other team members. For more information, download the Buyers Guide and make an appointment, in-person or virtually, to find out how they can put together your Homebuying Team. In that appointment, ask the agent to explain agency and its benefits to you in your upcoming transaction. Fortunately, you need only call The Sam Team at Houston Top Realty. We've done the hard work . . . for YOU!

Read More-

Homeowners Need Resources Managing an asset worth hundreds of thousands of dollars is a responsibility that requires attention to details such as timely payment of the mortgage, home repairs and maintenance, upkeep, and oversight on financial issues including taxes, insurance, and other things. Depending on how long you've been a homeowner, you may have faced some of the decisions common to homeownership. Occasionally, there could be something new that you haven't had to deal with in the past. This is where having resource you can rely on becomes valuable. During the buying or selling process, it is natural to turn to your agent for information and advice but during those periods in between where do you go for counsel? Sure, you can turn to the Internet but that may not be the best place to get advice for your situation. We encourage you to think of us as your "source of real estate information"; someone you're comfortable to ask a question and confident that you'll get good advice. We not only want to be there for you when you buy or sell, but all the years in between. By helping you with the day-to-day decisions of homeownership, we believe we can develop relationships that will lead to future sales when you move again, as well as recommendations to your friends who need the services of a trusted real estate professional. Whether you simply need the recommendation of service provider, a trustworthy mortgage professional, an estimate of your current market value, or advice on what kind of improvements are best to consider, we're happy to share that information with you. Just a few of the kind of questions we get almost every week: Can you recommend a good (plumber, painter, handyman, etc.) What is the current value of my home? How do I challenge a property tax assessment? When should a homeowner refinance? How often should we update our personal home inventory? We want to be your "Go-To" person for everything to do with real estate. If you have a real estate question, please call us at (281) 710-3090. If we don't have the answer, we'll find it for you or at least, point you in the right direction.

Read More Waiting for the Mortgage Rates to Come Down?

Waiting for the Mortgage Rates to Come Down? Waiting for the mortgage rates to come down before you buy a home may not be a good decision. If you are correct, and the rates do come down by two percent, the savings you benefit from a lower rate will most likely be devoured by the appreciated price increase. As of 10/27/22, the 30-year fixed-rate was at 7.08% which is the highest level since April 2002. If the rate drops to 5% in three years but the price increases by 5% a year, a $400,000 home today, will cost $463,050 three years from now. An increasingly, popular option that more buyers are considering is to purchase the home today with an adjustable-rate mortgage that could give them a 5.96% rate for five years. Then, refinance to a fixed-rate when rates come down. Not only will the buyer have lower payments with the ARM, but the buyer will also own the home, and benefit from the appreciated prices which will build equity in the home and increase their net worth. Mortgage rates have increased over 3% in the first three quarters of this year. Some would-be buyers are wishing they had a do-over so they could get into a home at a lower rate. The current differential between the fixed and adjustable rates are substantial and could lower the monthly payment. The lower adjustable-rate would save a buyer $323.90 a month during the first period of five years. At any point during that period, they could refinance at better interest rate should it become available. However, if the rates do start trending down, the homeowner might decide not to refinance because the rate on the ARM would have to go down at the next adjustment period to reflect the lower of rates in the market. Mortgage rates have been low since the housing crisis that caused the Great Recession. The government kept them low to build the economy. Then, the Pandemic threatened the economy, and the government spent a tremendous amount of money to bolster the economy which led to inflation which is what is causing the rates to increase currently. When inflation is under control and back to acceptable levels, the rates should lower. Home prices are a different situation. The recent rise in mortgage rates has cause home prices to moderate because it affects affordability. Inventories are still low and there a pent-up demand for housing from purchasers unable to buy during the pandemic. This coupled with millennials reaching household formation age and insufficient home building to keep up with demand for the last decade, prices are expected to continue to rise. The rate of appreciation could even increase when rates come down which would also increase affordability and demand. Buyers who feel they missed a window of opportunity to buy before rates started increasing should investigate financing alternatives. Reach out to us and we can discuss the options that are available.

Read More"Do you feel lucky? Well, do ya?"

"Do you feel lucky? Well, do ya?" You may remember the famous line in the Dirty Harry movie when Clint Eastwood has just had a shootout with bank robbers and is standing in front of the lone surviving thief who is considering going for his gun. Harry with his gun pointed at the bad guy says to him ""Did he fire six shots or only five? Well, to tell you the truth, in all this excitement, I kinda lost track myself. But being this is a 44 Magnum, the most powerful handgun in the world and would blow your head clean off, you've gotta ask yourself one question: Do I feel lucky? Well, do ya?" Our economy has had a long recovery from the great recession, due in most part to the housing crisis of 2007-2009. Then, the Pandemic hit in 2020 which tanked the worldwide economy but the surprise to homeowners happened to be housing. 2021 became a red-hot market with prices going up by 21% nationally. In 2022, mortgage rates have increased by four percentage points and haven't been this high since 2008. Inflation, at the end of September, reached a 40-year high at 8.2%. The Fed recently said they'll continue raising rates until they can get inflation near their target of 2% annual rate. People who own homes have seen their values go up dramatically and so has their net worth. Due to the extremely low inventories and the maturing millennial market, there is a lot of pent-up demand for housing. This leads us to the scene in the movie. You may be considering buying a house now but at the same time, you're thinking "Have prices and mortgage rates hit the top of the market so they'll start coming down or will they continue to go up, making it cost more to get into a home?" The facts are that the U.S. is the strongest economy in the world. The housing bubble of 2007 was created by over-inflated property values and predatory lending practices. Those conditions don't exist today. There is a housing shortage in America due to not enough homes being built to keep up with demand and people staying in their homes longer. Homeowners have record amounts equity in their homes and foreclosure rate hit a historic low at the end of 2021 even though it edged up a bit in spring of 2022 as reported by CoreLogic. Homes are expected to continue to appreciate but not as fast as they did in 2021. The revised predictions for 2022 appreciation vary from Fannie Mae at 16%, Freddie Mac at 12.8% to NAR at 11.5%. NAR Senior Economist Nadia Evangelou recently said "Mortgage rates are a heartbeat away from the 7% threshold. According to Freddie Mac, the 30-year fixed mortgage rate rose to 6.92% from 6.66% the previous week. While inflation remains elevated, mortgage rates will continue to move up, making homeownership even further out of reach for many." If the home you could buy this year for $500,000, will cost you $550,000 next year and the mortgage rate goes up from 6.5% to 7.5%, the payment will go from $2,844 to $3,461 based on a 90% mortgage for 30-years. If interest rates are temporarily high based on the Fed's position to lower inflation, a home could be purchased at today's price and refinanced later when the rates come down. 5/1 adjustable rate mortgages allow a borrower to lock in a lower initial rate for five years which would allow a person to find the best time to refinance. So, back to the movie scene... "you've gotta ask yourself one question: Do I feel lucky? Well, do ya?" The answers? #CallSamGetSold #TheSamTeam at #HoustonTopRealty

Read More-

WHEN WILL THE MARKET TURN? Housing affordability has declined dramatically in 2022 due to continued rising home prices and a three-percentage point jump in mortgage rates. Based on the popularity of Google searches for "housing bust" or "housing bubble", it could be surmised that buyers are anticipating relief, but they are probably not going to see it anytime soon. Home price appreciation is moderating and is down from the 20% level experienced in 2021. Some of the major industry prognosticators are estimating anywhere from 9% to 14% for 2022. Interest rates are expected to continue to rise through the end of 2022 and could be at 7%. Freddie Mac 30-year fixed-rate mortgage was 6.66% on October 6, 2022. Even though homes currently for sale increased to 3.2 months in August 2022, it isn't that much more than it was for the same month in 2021 when it was at 2.6 months. Most markets are still entrenched in favor of sellers because a balanced market between buyer's and seller's is at six month's supply. While buyers may be feeling that a new home is no longer affordable, there are several affordability indexes that provide a baseline for objective measurement. The National Association of REALTORS® produces a monthly index. Affordability is determined by indicating a median income person/family can afford to purchase a median priced home with a 20% down payment based on a 25% qualifying ratio for monthly housing expense to gross monthly income. The index is structured so that a value of 100 indicates that a family with the median income has exactly enough income to qualify for a mortgage on a median priced home. When the index is above 100, the family has more than enough to qualify. The NAR Housing Affordability Index for 2019, 2020, and 2021 was 159.7, 169.9 and 152 respectively. It was 143.1 in January and by April had decreased to 108.1 and the preliminary number for June is 98.5. The decrease in the index is directly affected by rising interest rates and home prices outpacing family income. Home sales were seasonally adjusted in August to be 4.8 million which is down .4% from the previous month and down 19.9% from August 2021. Lower sales are partly a function of a smaller pool of eligible buyers and concerns about a variety of economic conditions. This may not sound like good news for buyers whether they are labeled first-time or move-up, but it is an objective view of the market. It has become more expensive to buy a home now and will continue to increase in the future. Getting into a house using whatever devices are necessary can at least put the momentum on your side. Homes are appreciating faster than inflation and the fact that leverage improves the growth rate due to using borrowed funds to buy the home is also to the buyer's advantage. So, getting back to the original question "when will the market turn to make homes more affordable?" It may not be a dramatic change but more likely, a subtle one. Prices will moderate by still appreciating but not as much as in 2021. Inventories will increase slightly but won't affect price because the low supply has been almost a decade in the making and it will take time to reach balance in the market. Mortgage rates are not as low as they were, but they never were before in the history of the U.S. Millions of people had mortgages in the 1980's that were as high as 18.5%. Buyers financed the homes at the going market rate, sometimes with creative financing, and refinanced the properties later when the rates came down and the values had gone up. Real estate is still a great hedge against inflation, and many times, the largest and best investment individuals have. The Federal Reserve Survey of Consumer Finances found that homeowner's net worth is 41 times greater than renters.

Read More Mortgage Rates add "Cause to Pause"

CAUSE TO PAUSE Rising mortgage rates are causing some would-be buyers to pause their decisions until they determine whether rates are going to come back down. While it may be possible, the probability is that prices are going to continue to increase. On December 23, 2021, the 30-year fixed-rate, according to Freddie Mac, was 3.05% and is at 6.29% as of September 22, 2022, a 3.24% increase. On a $360,000 mortgage, the principal and interest payment went from $1,528 to $2,226. The $698 difference represents a 46% increase in the payment. It seems understandable to pause and see if rates will come down again, especially since they went up so fast, but it probably isn't going to happen anytime soon based on the Fed's position on controlling inflation. The fact that inventories are growing slightly, and market times are increasing doesn't negate that supply cannot keep up with demand and homes are continuing to appreciate, albeit, not as much as they did in 2021. If a person waited a year to see if the rates come down but, in the meantime, the prices increased 10% and the rates stayed the same, the home in the example above, would have a $226 larger P&I payment. As an alternative strategy, the buyer could purchase the home on a 5/1 adjustable-rate mortgage with a 4.64% rate for five-years. Instead of $2,226 for the P&I payment for the fixed rate at 6.29%, the payment on the ARM would be $1,926, a $300 savings. They would have purchased the home at today's prices, avoiding appreciated prices and would have five years to refinance at a lower fixed rate should they come down. Assuming the rate adjusted upward the maximum amount at each period, it would take over seven years to exhaust the savings on the lower payments for the first five years. It is unfortunate that some buyers missed a window of opportunity to purchase last fall when mortgage rates were near an all-time low. That window has closed, and it may not open again. People who can still afford to buy, even though rates are significantly higher, are taking a risk waiting for rates to come down. Even if they are correct, the prices will be higher, offsetting any possible savings. If they are wrong, both prices and rates will be higher, and they may be priced out of the market. In the 1980s, when mortgage rates topped 18%, the best real estate agents in the country presented alternative financing choices to buyers. If your agent hasn't had conversations with you about alternatives to fixed rate financing, there could be options available that you need to consider. Depending on your price range and individual situation, investigate local and state financial assistance programs, ARM Comparison, 2/1 Buydown, and Cost of Waiting to Buy and download our Buyers Guide. For more information or to get answers to your questions, call us at 832-200-5656. #TheSamTeam at #HoustonTopRealty #HoustonHomes #Pearland Homes

Read MoreAre Prices and Rates going to Continue to Rise?

One of the most talked about questions in the real estate market has to do with "Will prices continue to rise now that interest rates have increased dramatically this year?" It is understandable to think that if the Federal Reserve is using interest rate increases to slow consumer demand, that it would also slow homebuyer demand to moderate prices. Unfortunately for would-be homebuyers, it isn't the case. High inflation, strong economic growth, low unemployment, and increased wage growth have been associated with high home price appreciation. In a recent newsletter from First American, Chief Economist, Mark Fleming stated that historically, 90% of total inventory is from existing homes and homeowners are not moving as often as in the past. Prior to 2007, the average tenure was five years. After the housing crisis, between 2008 and 2016, the length of time spent in a home went to eight years. Lawrence Yun, Chief Economist with the National Association of REALTORS� when talking about the May 2022 statistics: "Nonetheless, homes priced appropriately are selling quickly and inventory levels still need to rise substantially ... almost doubling ... to cool home price appreciation and provide more options for home buyers." Median sales price rose to a new high of $403,800, up 10.8% from July 2021, while sales are down 20% year over year and inventory increased slightly to 3.3 months from 2.6 months in July of 2021. In the beginning of 2022, Fannie Mae, Freddie Mac and NAR predicted home price appreciation would be 7.6%, 6.2%, and 5.1% for the year. Their revised forecast has been increased to 16%, 12.8%, and 11.5%. Buyer demand still exceeds inventory levels which is driving prices higher. While the Fed does not set mortgage rates, it does determine the Fed Funds Rate which is charged by banks to each other for overnight funds. The increases often affect the U.S. Treasury rates to increase and there is generally a reaction when the 10-year U.S. Treasury Note yields increase for the 30-year mortgage rates to increase also. The National Association of REALTORS�, on their website, states "The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data." The Index uses the 30-year fixed rate mortgage as provided by Freddie Mac's Primary Mortgage Market Survey (PMMS). Mortgage rates have gone up over 2% in the first half of 2022. That dramatically affects the affordability of the home even if the price didn't increase, which it did. A $360,000 mortgage at 3.05% in December 2021 would have a principal and interest payment of $1,528 for 30-years. At 5.22% as of August 11, 2022, the P&I payment is $1,981 or a difference of $453 dollars or a 30% increase. As of May 2022, homeowners are now staying in their homes 10.6 years. Part of the reasons can be contributed to the pandemic, but a large degree is attributed to the lack of inventory. Existing homeowners can sell their home for premium prices and in unusually short time frames, but the problem is finding a home to replace it. The demand for housing still exceeds the supply and price are continuing to rise, although, maybe not as the same pace as 2021. Many economists predicted that price appreciation would slow but CoreLogic reported "Home prices nationwide, including distressed sales, increased year-over-year by 20.9% in April 2022 compared with April 2021. In the same report, CoreLogic predicted "...home prices are forecast to increase on a year-over-year basis by 5.6% from April 2022 to April 2023." Another frequent question homeowners have is whether to wait to see if prices moderate and interest rates decline. The probability is more likely for prices to continue to increase along with mortgage rates. The consequences of waiting, in hopes of lower prices and rates, could totally price a person out of the market for the home they want. Using a $400,000 home that could be purchased today at 5.22% on a 90%, 30-year mortgage, the P&I payments would be $1,981. If the price appreciated only 5% in the next year and the mortgage rates were to go up by 1%, the payment would increase by $339 a month. If a person stayed in the home for 7 years, the increased cost would be $28,458 and if they stayed for full term, it would cost them $121,965 more by waiting. Increases in rates and prices have forced some people out of the market, at least temporarily. For the fortunate ones, who can still afford to buy, even with the increases, acting now could save them tens of thousands and maybe hundreds of thousands depending on the price of the home. Make an appointment with The Sam Team at Houston Top Realty to get the facts on what you home is worth, the mortgages available, and the logistics to put it together for your best advantage.

Read More-

Is the Market Crashing??? The seller's market was RED HOT in the first 5 1/2 months of this year. Up until that time, 70% of homes that sold went Above Asking Price! Wow! That is unprecedented! Year-over-year home prices went up more than 20%! Unbelievable!!! But unsustainable. But what happened in June? Homes did not receive multiple offers in 3 days. Prices did not go over asking price. Interest rates "skyrocketed up to 6%!" Home buyers began to cancel their contracts before closing! Many sellers lowered their list prices! Instead of taking 2-3 days to sell, homes started taking 2-3 weeks or months to sell! Did the market crash? The short answer is NO! The market isn't crashing; rather, it's normalizing but still red hot! You see, a "normal" market usually has marketing times of 3-6 months. Price lowering is common to stimulate interest and accommodate a lack of updates. Although 6% interest is higher than the 2-3% we saw earlier in the year, it wasn't that long ago that I refinanced my own home at 6% and thought it was a give-away! I also worked through the early 1980's when interest rates of 16-17 1/2% were the norm! So market changes are the norm, my friend -- always have been and always will be. But remember this today: There is strong demand for housing, the supply is low, interest rates are normal, people have jobs, that is, employment is high, and many have cash in the bank! That is the formula for a strong real estate market, albeit normalized. The way to navigate the market is to consult with an experienced professional who you can trust to give you great advice. And of course, that is the exceptional agents of The Sam Team at Houston Top Realty. We are here to give you the benefit of 47 years full-time experience ONLY in the Greater Houston market. It is still a great time to sell . . . and also a great time to buy! Real estate is still your best hedge against inflation, and your best approach to building long-term sustainable wealth. Call us at 832-200-5656 for a free consultation or email info@TheSamTeam.com with you questions. We want to be Your Realtors® of Choice!

Read More -

BUY BEFORE YOU SELL? Sure! A common concern for homeowners is that if they sell their home first, they may not be able to find another home to buy. It is understandable with the low inventories currently available in most markets, but a strong argument can be made to buy your replacement home first. In fact, there are some advisors that would tell you not to sell at all. Instead, keep the home for a rental investment and refinance it to pull out some cash for the down payment and closing costs for the new one. Many homeowners recognize that their home has been an excellent investment for them. Their home may have outperformed their retirement and other investments. In all likelihood, homeowners understand the management and benefits of a single-family home far better than they understand stocks, mutual funds, annuities, or ETFs. Just as there are low inventories of homes for sales, there are shortages of available single-family homes for rent, as is evidenced by rent continuing to rise. Rising prices and rents contribute to the rates of return that rental properties enjoy. A homeowner, assuming they have good credit, can borrow the difference in their unpaid balance and 80% of the fair market value of their home. The proceeds are most likely not a taxable event and can be used to purchase the replacement home. It is likely that the rent could cover the total payment on the refinanced former home. The seller, then, benefits from income, depreciation, equity build-up, appreciation, and leverage. There is even a window of opportunity possible for the homeowner to rent it for a while, which covers his payment, allows the home to continue to appreciate, and then, sell and close it within two years and still be eligible for the section 121 exclusion of gain in a principal residence. The homeowner may find that the investment is providing a better return than alternative investments and keep the rental beyond the two years. At some later date, if the homeowner wanted to dispose of the property and buy another more expensive rental, a section 1031 exchange may be available to avoid capital gains for a while longer. Many economists feel that the low inventory situation in most of America is going to be a long-term event due to over a decade of underbuilding and maturity of the millennial generation. This will continue to propel both home values and rents; both of which are good for investors. Buy before you sell but they don't have to be at the same time; they can be years apart. Do a cash-out refinance on your current home for the proceeds to buy another home that meets your needs now. Then, convert your current home to a rental investment. Don't wait because rising interest rates will increase your payments on not only the new home but the refinanced home also. Talk to your real estate professional about what the fair market value of your current home is now, what you can expect to pull out of it and what it would rent for. Download our Rental Income Properties guide for more information. Attachments area

Read More When are the Negotiations Over?

When are the Negotiations Over? The primary negotiation in a home purchase takes place when the contract is agreed upon that includes the price, closing and possession. With inventory down over 19% in the past year and multiple offers being more of the norm than the exception, the first round of negotiations can be challenging. Buyers and sellers alike feel relieved once it has resulted in an agreement, but experienced agents know there is more to come if there are contingencies for financing, inspections, or other things. The competition for the home may be so tough that the buyer waived their rights for what would be normal contingencies. Financing is one of the most common contingencies in normal situations but when multiple offers are involved, the cash offers tend to have the advantage. If you don't have the resources to make a cash offer, the next best position is to be pre-approved with a commitment letter from the lender. Arrange for the lender to confirm the pre-approval directly with the listing agent prior to the listing agent presenting the offer. There have been buyers who know they don't have the cash to close and apply for a mortgage anyway and try to reinsert the provision outside of the contract. Experienced listing agents will advise the seller to have the buyer provide proof of funds necessary to close and verify that they do indeed exist. The purpose of an inspection is for the buyer to receive an objective evaluation about the condition of the home and its components to identify existing defects and potential problems. The expense for inspections can be several hundred dollars and it's reasonable for buyers not to want to spend the money before they find out if they can come to terms with the seller. From a different perspective, sellers want to know quickly if the buyer is going to reject the home due to the inspections because they could be losing time. For that reason, inspection time frames are limited to a few days from acceptance of the offer. Sometimes, buyers will expect sellers to make all the repairs listed on the report and this is where the second round of negotiations begins. If the seller refuses, the negotiations can go back and forth until the other party accepts the offer on the table. When purchasing a new home from a builder, it is expected for everything to be in working order; after all, it is new. However, it is reasonable to expect that existing homes, that are not new, have a different standard. While it's understandable that buyers would want to be aware about major items that are not in "working order", normal wear and tear of components based on its age should be expected. In a highly competitive seller's market, buyers might do whatever they can to get their contract accepted, realizing that there is another place to negotiate when they're not competing with other buyers' offers to purchase. The negotiations involved in a home purchase are not complete until the buyer and seller have signed the papers and the title has passed to the buyer. Up until the closing is finished, any item that comes up could prolong the negotiations. For this to be a WIN-WIN situation, both seller and buyer must feel good about the negotiations that led to transaction closing. Neither party should feel that the other party had an unfair advantage over them. For expert representation when buying and/or selling, call the experienced REALTORS® on The Sam Team at Houston Top Realty. 281-710-3090

Read More-

In today's ultra-competitive real estate market where there is only 1.7 months supply of inventory compared to 6 months in a balanced market, and the average home is getting 4.8 offers per sale, it is more important than ever to have the right person "champion" your cause. In the Middle Ages, it became customary for a person of nobility to appoint a "champion" to fight for them in their stead. Trial by combat ended in the 15th to 16th centuries but the practice of "fighting" or speaking in one's behalf continues even to this day. Lawyers will take up the cause of their client to win justice for them. Professional athletes are recruited for their abilities to help their team become victorious. Craftsmen of every type imaginable are in high demand because of their finished product. Sellers' and buyers' objectives are different and, in many cases opposing in nature. Sellers, rightfully so, believe they should get the most for their home while minimizing expenses and avoiding any issues that could cause delays. Buyers want to be treated fairly; have an opportunity to buy the home of their choice and enjoy the protections of normal contingencies for things like mortgage approval and inspections. In most situations, there are two real estate agents involved in a single sale. While there could be legal agency distinctions, it is commonly felt that the agent on their side of the transaction is "championing" their cause. It is natural to want your champion to be the most capable person available. There are skills that agents need in today's market not the least of which is negotiations. Regardless of which side of the fence you're on, your agent needs to be skilled in negotiating on your behalf. Every part of the contract is a negotiation starting with the price, then, whether it is cash or subject to a mortgage. What's a reasonable amount of earnest money? Can it be "as is" and still allow the buyer inspections so they'll be fully aware of what they're buying? The buyer wants to negotiate the best terms possible with the seller and they are depending on their agent to work for them to get them. The home inspector has been hired by the buyer to determine the condition of the home and will most likely, ask the seller to make any necessary repairs. The lender hires an appraiser to determine the value of the home so that the loan will be secured by the property. Recent sales are used as comparables, but they trail the market which becomes a challenge in rapidly appreciating markets, especially, when there are multiple offers. And since multiple offers are the norm currently, how is the best way to handle them based on the seller's or buyer's perspective. There could be legal and ethical procedures that must be followed but an agent's experience may also contribute to the favorable outcome. The skilled and experienced negotiator understands that every transaction is different because of dealing with individuals, their families, their needs, and their emotions. The role of the third-party negotiator can be invaluable to the success of the transaction based on not only their experience but the juxtaposition to the principals and their objectivity of trying to reach a compromise.

Read More Removing or Adding a Person to a Loan

In divorce situations, it is common, for the spouse who keeps the home to refinance to remove the other spouse from the loan. Equally as common, first-time buyers who don't have enough income to qualify may ask a parent to co-sign and must add their name to the mortgage. Another situation that requires removing or adding a person to a loan could be to qualify for a better interest rate. The difference in a minimally acceptable credit score and something that might be considered "good" could be as much as a 0.5% higher rate for the term of the mortgage. Consider that a couple is buying a home on a conventional loan, and they have individual credit scores of 760 and 670. The underwriters will price the loan based on the lower of the two scores. A half percent interest on a $400,000 30-year mortgage could have close to $110 a month difference. A possible solution to this dilemma could be available, assuming the borrower with the higher credit score had enough income to qualify for the mortgage separately. If so, that person would be eligible for the lower rate. The property could still be titled in both names and if so, that person would be liable for the mortgage should the named borrower default on the loan. Another scenario that may arise is that a couple has enough income to qualify for a mortgage but because one of the parties has a lower credit score, it will be priced higher. Having a parent or relative added to the mortgage as a non-occupying borrower to help with the credit score. Interest rates are determined on the lowest middle of three scores for the borrowers applying for the loan. Assuming the parent's score was higher than the lower score of the couple, it could improve the rate applied to the mortgage loan. The value of a trusted mortgage professional is very important. They can offer alternatives to situations that could be worth tens of thousands of dollars over the life of the mortgage and in some cases, can make the difference in being approved at all. The Sam Team would be more than willing to make a recommendation and can support the need to assemble a strong team to help with your transaction.

Read MoreOPPORTUNITY KNOCKING! Need Cash? Facing Foreclosure? Read this blog . . .

If you're a homeowner, you have a "hidden" savings account! If you're NOT a homeowner, you should be! (So call us!) With the rapid appreciation that homes have had in the last two years, most homeowners have equity. A common way to release part of the equity is to cash-out refinance but some homeowners may not be eligible currently. This type of loan replaces the current mortgage by paying it off and an additional amount of cash for the owner. Generally, lenders will consider a new mortgage up to a total of 80% of the current value. Typically, the rate on a cash-out refinance will be slightly higher than a traditional purchase money mortgage. As is in any lending situation, the rate depends on the borrower's credit and income. The best interest rates are available to borrowers with higher credit scores, usually over 740. Loan-to-value can affect the rate a borrower pays also. A 70% loan-to-value mortgage could be expected to have a lower interest rate than an 80% LTV because there is a larger amount of equity remaining in the property and therefore, less risk for the lender. There are no restrictions on how the owner can use the money. It can be used for home improvements, consolidating debt, other consumer needs or for investment. Eligibility Requirements as found in FNMA Selling Guide B2-1.3-03 Cash-Out Refinance Transactions "Cash-out refinance transactions must meet the following requirements: The transaction must be used to pay off existing mortgages by obtaining a new first mortgage secured by the same property or be a new mortgage on a property that does not have a mortgage lien against it. Properties that were listed for sale must have been taken off the market on or before the disbursement date of the new mortgage loan. The property must have been purchased (or acquired) by the borrower at least six months prior to the disbursement date of the new mortgage loan except for the following: There is no waiting period if the lender documents that the borrower acquired the property through an inheritance or was legally awarded the property (divorce, separation, or dissolution of a domestic partnership). The delayed financing requirements are met. See Delayed Financing Exception below. If the property was owned prior to closing by a limited liability corporation (LLC) that is majority-owned or controlled by the borrower(s), the time it was held by the LLC may be counted towards meeting the borrower's six-month ownership requirement. (In order to close the refinance transaction, ownership must be transferred out of the LLC and into the name of the individual borrower(s). See B 2-2-01, General Borrower Eligibility Requirements (07/28/2015) for additional details.) If the property was owned prior to closing by an inter-vivos revocable trust, the time held by the trust may be counted towards meeting the borrower's six-month ownership requirement if the borrower is the primary beneficiary of the trust. For DU loan case files, if the DTI ratio exceeds 45%, six months reserves is required." AND CHECK THIS OUT: If you're NOT eligible for a Cash-out Refi, you can Sell your house and get cash! With some new programs, you may be able to sell your house AND rent it back until you can repurchase it! For more information, call your Top Agent at The Sam Team. We want to be your REALTORS® for life!

Read More-

Based on the current competition due to lower than normal inventories, it is possible for a seller to find themselves on the beneficiary side of a multiple offers. Two or more parties may be trying to buy your home at the same time and because of the competition, they increase the purchase price, possibly, remove unnecessary contingencies and try to make their offer as attractive as possible. This can pleasantly result in you realizing higher-than-expected sales price and proceeds of sale. While it may not materialize, it is good to understand what could happen and the best way to handle it. Your real estate professional is positioned to offer you specific advice but the following are some things to consider. One tactic is to delay showings for a short period of time. Some agents will create this by putting a sign on the property with a rider that indicates "coming soon" and depending on the local MLS rules, it may even be put in the system. No showings will be allowed until a publicized date, usually, a few days, at which time, the goal is to have prospective buyers standing in line to see the home. This might even be combined with an open house scheduled for the initial showings. Agents using this method have sometimes found lines of people waiting outside the home to see it first. When multiple offers are made, invariably, there will be some disappointed people and for that reason, it is essential to follow a strict procedure to see that no one is given an advantage over other buyers. Discuss the following suggestions with Sam: All offers are countered by asking the buyer to make their "best and final" offer which will include not only price but terms also. The seller may authorize the listing agent to disclose that there are multiple offers. (Article 1, Standard of Practice 15 of the National Association of REALTORS® code of ethics. Discuss with Sam his thoughts on revealing information, like price and terms, on other offers you are considering. In most cases, they are allowed to do so with your permission, and it may make a difference in the negotiations. If one offer is substantially better than the other offers, the seller can accept or counter-offer. Have Sam advise you of countering more than one offer which could result in contracting to sell your home to more than one person. He can advise you alternative ways to do this. Keep this in mind. Sometimes, the highest offer is not the best offer. Even though the buyer is willing to pay a high price for your home and possibly, willing to remove the financing condition, if they are going to get financing and it doesn't appraise, it can cause issues. Sam knows to advise you to ask for proof of funds from a cash buyer or confirming their ability to pay above appraised value. Sam and The Sam Team can help you realize the most out of your home. That's why we say, Call Sam. Get SOLD!

Read More -

Introducing the RE/MAX Top Realty Sellers' Advantage Plan -- Get CASH offers instantly from iBuyers, Power Buyers, and Bridge Buyers. You can also Buy before You Sell! We give you ALL the options from ALL the Top Buyers! Get FREE information Right Now! Simply copy and paste YourSamTeam.com into a new window for immediate access.

Read More Independence Day is a Time to Celebrate that we’re ALL Americans and we’re FREE!

The 4th of July is a day for family and friends to gather together, eat good food, and have fun. We are celebrating our nation’s independence from Great Britain after winning the Revolutionary War. It’s also just an excuse to get outside with your friends and family on a summer day! Fireworks are always great entertainment – they’re beautiful and exciting! And finally, it’s about uniting as one nation under God, where all people are created equal regardless of race or religion. It was declared an official federal holiday in 1870 by President Ulysses S Grant as part of his “Uniform Monday Holiday Act” which established Labor Day as a national holiday (June 27) and Memorial Day (May 30) as well as several other holidays throughout the year including Washington’s Birthday (February 22), Lincoln’s Birthday (February 12), George Washington’s Birthday (February 22). This law also created three more holidays that were not mentioned above; Thanksgiving Day November 23, Christmas Day December 25, New Year’s Day January 1st. So this 4th of July, let’s remember to not only celebrate our freedom, but all of those things that make us as Americans the envy of the world! May God bless you and yours this Independence Day! And remember the primary symbol of the American Dream is homeownership. If you or someone you know is thinking of buying or selling a home, won’t you please introduce them to us? Thanks, and Let’s have a BANG!

Read More-

If you are looking at buying a duplex or triplex, there are many things to consider before making the investment. If this is your first time purchasing these types of properties then it may be best to consult with an experienced real estate agent who can walk you through all of the considerations. For some people, renting out their property is a great way to earn money and generate monthly cash flow. The decision ultimately comes down to what type of investor you want to become and how much risk you’re willing to take on in order for that goal come true. I have been working with several builders who are changing neighborhoods with the new construction of duplexes. Because many neighborhoods have deed restrictions which disallow duplexes, many builders are looking in “renaissance” or “up-and-coming” neighborhoods where they raze old houses and build brand new duplexes. One such area is Sunnyside and South Park. These neighborhoods have the benefit of an amazing “near-the-loop” location and are at the age where the decline is over and the reconstruction is already beginning! Imagine buying a new home where you can live in one side (totally private) and rent out the other side to help cover the mortgage payment! It’s an incredible advantage!Now is the time to take advantage of some of the great offers which are presenting to us. And if you’d like to invest in building duplexes, we can help you with that, too, by finding suitable properties for renaissance. Here on TheSamTeam.com at RE/MAX Top Realty, we have agents educated in duplexes with financing opportunities available. Check it out . . . it may be a way for you to enter the hot Houston housing market affordably!

Read More How to Get Top Dollar when Selling Your Pearland-Houston Home

First, make sure the home is in tip-top condition. A good cleaning goes a long way, as does landscaping. Repair any little “annoyances” that you’ve learned to live with. Fresh paint and new or freshly shampooed carpets go a long way. Stage the home using what you have. Hire a decorator, or do it yourself. Declutter — especially the kitchen and bathroom countertops. Determine the ideal time frame for Getting Yours Sold. Check out the real estate market for recent sales, and how long they were on the market. Add 30-45 days (typically) to the number of “Days on Market” to get an idea of when you might be done. Develop an appropriate pricing strategy — yes, “strategy” designed to Get Yours Sold for Top Dollar in the shortest time possible with the least amount of hassles. Avoid “gimmicky” offers on television to buy your home — remember that their goal is to “flip” the home for a profit. Why give away your money when a good REALTOR® can usually get more money in your pocket! Choose a REALTOR® with proven strategies designed to help you keep more of your profit. Surprisingly, those cheap agents don’t always get more for you. In this case, with your most valuable asset, choose the BEST agent with experience to back it up. And of course, call The Sam Team at RE/MAX Top Realty. With over 46 years of proven Top Dollar Results, doesn’t it make sense to choose the best? Find out why your friends, neighbors, and family are saying, “Call Sam. Get SOLD!” 832-200-5656. TheSamTeam.com

Read More

Categories

Recent Posts